california mileage tax proposal

Mileage Tax Could Drive More Middle-class Residents From California by Warren Mass December 14 2017 A proposal to charge California drivers for. I dont want to sell my home but it is time.

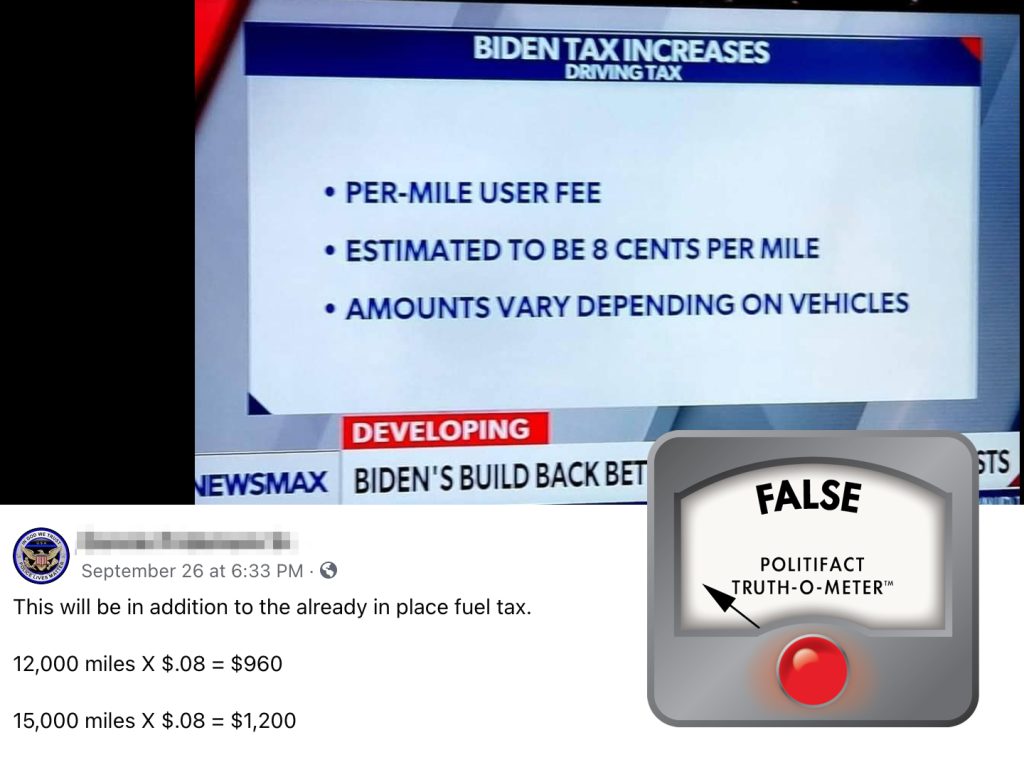

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

F Californias progress toward developing and implementing a mileage-based financing mechanism has been heightened with the issuance of Executive Order No.

. What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas. The four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 was envisioned as a way to help fund SANDAGs long-term regional plan an. 24 California motorists pay 437 cents per gallon on gasoline taxes.

I have been resisting against all common sense leaving California completely. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan. Todd Gloria says he doesnt want a Mileage Tax right.

Under the plan starting in 2030 it will cost 33 cents per mile. The state recently road-tested a mileage monitoring plan. California Expands Road Mileage Tax Pilot Program.

As of Aug. Reform California Holds Town Hall on SANDAG mileage tax proposal December 2 2021 San Diego News Desk Written by Vincent Cain On Tuesday Residents of San Diego gathered to learn more about SANDAGs proposed mileage and sales tax. Vehicle Miles Traveled California an already high-tax state wants to double its tax revenue.

Today this mileage tax. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive. Exploring the state of a motoring California Caltrans is conducting a series of user-fee based.

This means that they levy a tax on every gallon of fuel sold. The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. That is the equivalent of.

California is the second state to test mileage fees joining Oregon and there are plans to try this in nine other western states. Have found Florida to be much. The proposed tax and two half-cent regional sales taxes scheduled for 2022 and 2028 would help pay for SANDAGs long-term regional plan an ambitious 30-year 160 billion proposal which could.

The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area lawmaker. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. The plan would add another few cents onto already existing taxes.

The California Mileage Tax proposal would require tracking every drivers mileage and charging them four cents per mile they drive. In response Carl DeMaio Chairman of Reform California and leader of the campaign opposing the Mileage Tax proposal offers the following statement. Traditionally states have been levying a gas tax.

California and San Diego Countys newest tax proposal. Californias Proposed Mileage Tax California has announced its intention to overhaul its gas tax system. Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

If you thought it was expensive to own a car and drive in California before you need to grab your wallet because its about to get a lot more expensive under a proposal from California Democrat politicians. When it comes to costly tax hikes we dont trust Todd Gloria for a second. 80-cent-per-gallon INCREASE The Vehicle Mileage Tax would require tracking every drivers mileage and charging them 004-006 per mile they drive.

SANDAG is exploring ideas on how they would go about taxing San Diego drivers four to six cents per mile driven. That is the equivalent of an 080 per gallon increase in gas tax. SANDAG leaders say the plan would help fund future transportation needs and encourage use of mass transit.

But its not just a question about money its also a question about fairness. California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. Gavin Newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases.

Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades due to gas. It would change from per gallon to per mile under the vehicle mileage tax. The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a.

N-79-20 in September 2020 which requires a complete transition to a fully zero-emission new vehicle state auto market by 2035. Gloria claims he will remove the Mileage Tax later on. The money so collected is used for the repair and maintenance of roads and highways in the state.

36 cents on diesel. 600-800 a year The typical San Diegan driver will be forced to pay 600-800 more a year to drive on roads they already.

Desmond Sounds Alarm On Proposed Sandag Mileage Tax Valley Roadrunner

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Demaio Leads Fight Against Mileage Tax In California

A By The Mile Tax On Driving Gains Steam As A Way To Fund U S Roads

Sandag Board Discusses Future Per Mile Road Usage Tax The Coast News Group

Opinion Sandag S Proposed Per Mile Road Use Charge Is Misunderstood But It S Needed The San Diego Union Tribune

Opinion A Good Argument For Sandag S Road Mileage Tax The San Diego Union Tribune

Kusi News On Twitter Are You In Favor Of Sandag S Proposed Regional Transportation Plan The Plan Includes Various Tax Increases Including A Mileage Tax Republicans Have Voiced Opposition To Their Plan But

Sandag Board Eyes Future Per Mile Road Usage Tax To Fund Transit Projects Times Of San Diego